Kenya has emerged as a beacon of innovation and entrepreneurship in Africa, establishing itself as a leading hub for technology and startups on the continent. Over the past decade, the country has witnessed a remarkable surge in tech investment, propelling the growth of startups that are revolutionizing various sectors. As the landscape evolves, several investment trends are shaping the future of Kenyan tech startups, making it an exciting time for entrepreneurs and investors alike.

The Rise of Fintech

One of the most notable trends driving the Kenyan tech startup scene is the growth of financial technology, or fintech. With a large portion of the population unbanked and a growing smartphone penetration rate, fintech solutions are rapidly gaining traction. Startups like M-Pesa, a mobile money transfer service, have set the tone by demonstrating the viability and demand for digital financial services.

Investors are keenly aware of the significant market potential, leading to increased funding in fintech ventures. Recent years have seen the emergence of several successful fintech startups such as Flutterwave, Kasha, and Tala, attracting both local and international investors. The rising interest in digital payments, micro-lending, and online banking solutions is indicative of a broader shift towards financial inclusion—an area that remains a golden opportunity for investors.

Impact-Driven Investing

Kenya is home to numerous tech startups that are not only focused on profitability but also on solving pressing societal challenges. This alignment with impact-driven investing has become a key trend. Investors are increasingly looking for opportunities that promote sustainable development, gender equality, and environmental sustainability.

Startups like Twiga Foods, which aims to streamline the agricultural supply chain, and Kivo, which focuses on sustainable energy solutions, have attracted attention due to their commitment to addressing social and environmental issues. Impact investing is reshaping the funding landscape in Kenya, drawing in funds from socially responsible investors who prioritize both financial returns and positive societal impact.

Venture Capital Ascent

Venture capital (VC) investment in African startups has risen significantly in recent years, with Kenya being at the forefront of this growth. Numerous VC firms are actively seeking opportunities in the Kenyan market, recognizing the immense potential for high returns. Notable players such as Novastar Ventures, AngelHub, and CDC Group have invested heavily in Kenyan startups, bringing in both monetary support and mentorship.

The growing number of accelerators and incubators in cities like Nairobi also plays a critical role in nurturing talent and innovation. Programs such as the Nairobi Innovation Support Program (NISP) and the iHub provide resources and networking opportunities for aspiring entrepreneurs, further enhancing the startup ecosystem. This supportive environment, combined with the influx of VC capital, is creating a vibrant landscape for tech startups.

Ecosystem Expansion

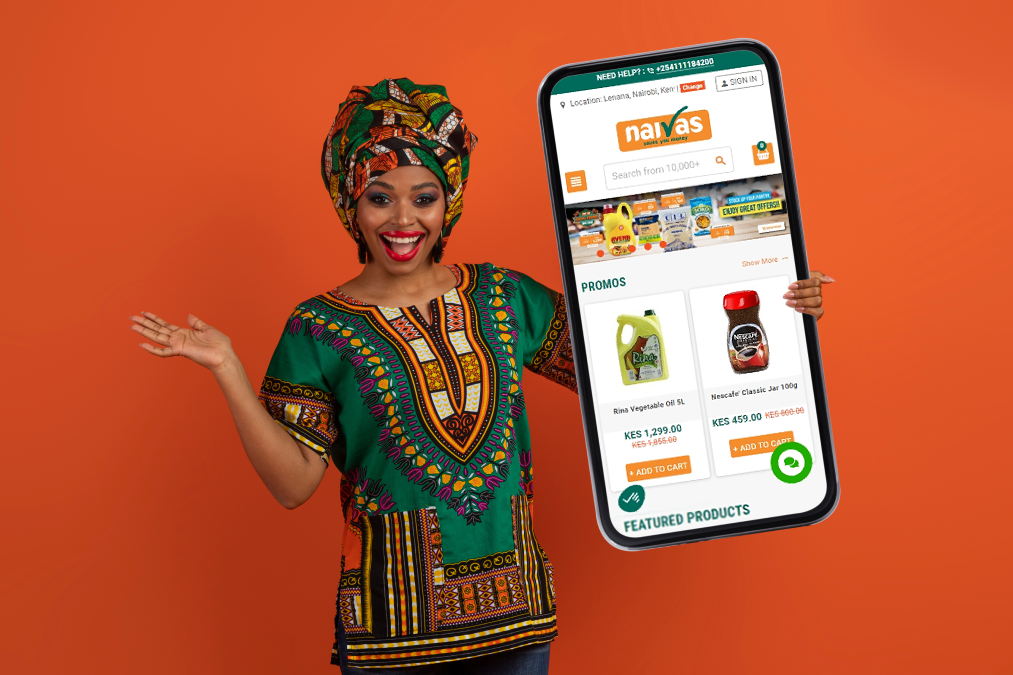

The Kenyan tech ecosystem has seen significant growth in collaboration and partnerships among stakeholders. Corporations are increasingly looking to collaborate with startups, giving rise to a trend known as corporate venture capital. Established companies are investing in startups to drive innovation, enhance their product offerings, and tap into new markets. This trend not only provides startups with the necessary funding but also opens doors to valuable expertise and industry connections.

Moreover, the government is taking steps to foster a conducive environment for tech startups. Initiatives like the Digital Economy Blueprint and the introduction of tax incentives for tech companies aim to boost innovation and attract foreign investment. Such measures are designed to promote a dynamic ecosystem where startups can thrive and scale.

Digital Transformation and Remote Work

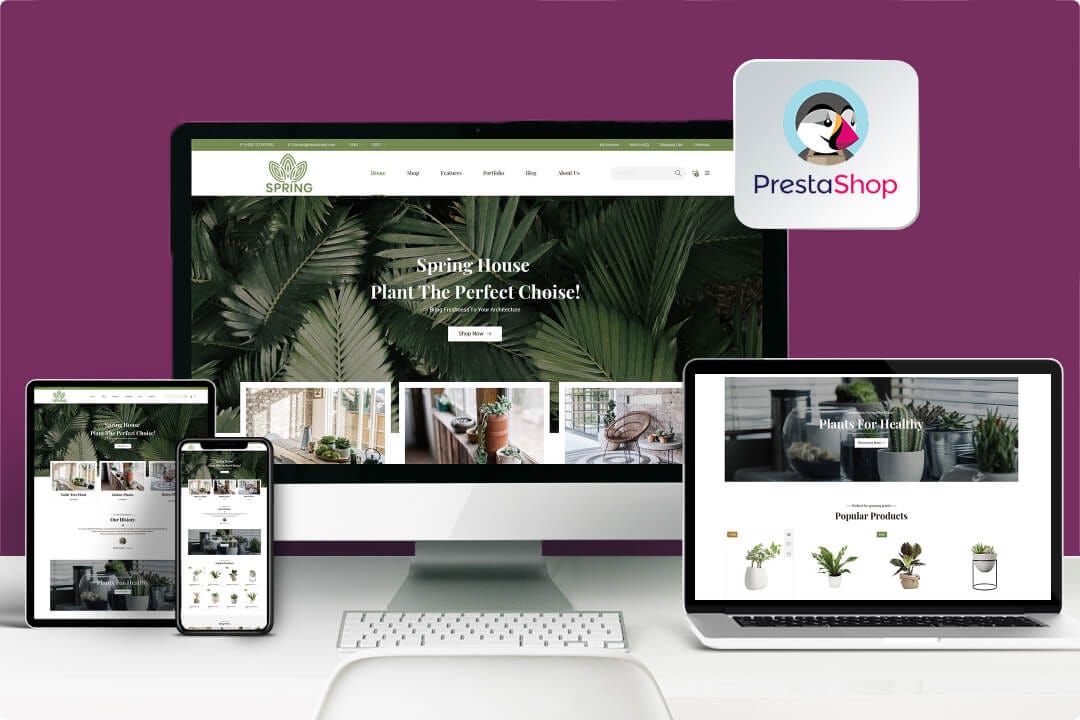

The COVID-19 pandemic accelerated the adoption of digital solutions, giving rise to a new era of remote work and digital transformation. Startups focusing on e-commerce, edtech, and remote work solutions have received significant attention from investors. As businesses worldwide adapt to new digital realities, Kenyan startups are positioning themselves to cater to this demand.

Companies like Andela and Daba can be seen as pioneers in creating remote work solutions and education platforms that connect talent with global employers. The pandemic underscored the importance of technology in facilitating remote work, fuelling investor interest in tech ventures that align with this trend.

Conclusion

The intersection of innovation, investment, and societal impact is charting an exciting course for Kenyan tech startups. As the funding landscape continues to evolve, trends such as the fintech boom, impact-driven investing, venture capital ascent, ecosystem expansion, and digital transformation are shaping the future of entrepreneurship in the country. With the right support mechanisms, a commitment to solving local challenges, and a collaborative ecosystem, Kenyan tech startups have the potential to thrive, not only within the continent but on the global stage as well. The journey of funding the future is well underway, promising a vibrant landscape of opportunities for innovators and investors alike.